RETIRADA CARNET

SALARIO MÍNIMO | COPILOT

Tarjeta UTA

TARJETA UTA

La mayor red de EESS en Europa

55.000 estaciones de servicio en 40 países europeos

Recuperación de impuestos

RECUPERACIÓN DE IMPUESTOS

IVA, TIPP y Gasóleo Profesional

Rescata el IVA, TIPP y gasóleo profesional de tus rutas por Europa

Gestión de peajes

GESTIÓN DE PEAJES

Cruza Europa sin parar

Circula libremente por todas las carreteras de cualquier país europeo.

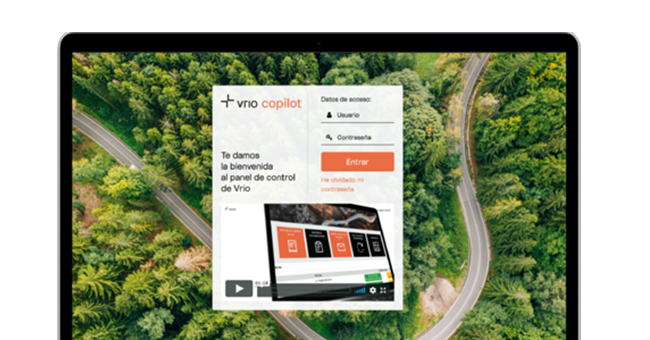

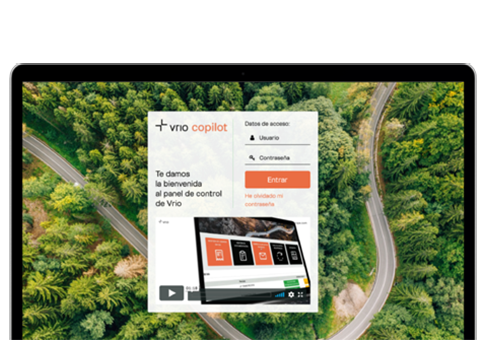

Vrio Copilot

VRIO COPILOT

Tu panel de control 360

La plataforma de gestión integral para el transporte y la movilidad